arkansas estate tax return

State Income Tax PO. This tax is item 5b on the Arkansas Estate Tax Return Form.

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

Mail Tax Due Returns to.

. Effective tax year 2011 the. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. The types of taxes a deceased taxpayers estate.

A return for the estate or trust for which heshe acts provided any of the following apply. State Income Tax PO. Be sure to write your Social Security Number and.

603 - Penalty for Underpayment of Estimated Tax. Any income of such estate or trust is currently distributable. Department of the Treasury.

Box 2144 Little Rock Arkansas 72203-2144 Mail Refund Returns to. Little Rock AR 72203-3628 If you owe tax make your check or money order payable to Department of Finance and Administration. Get instant answers to hundreds of questions about.

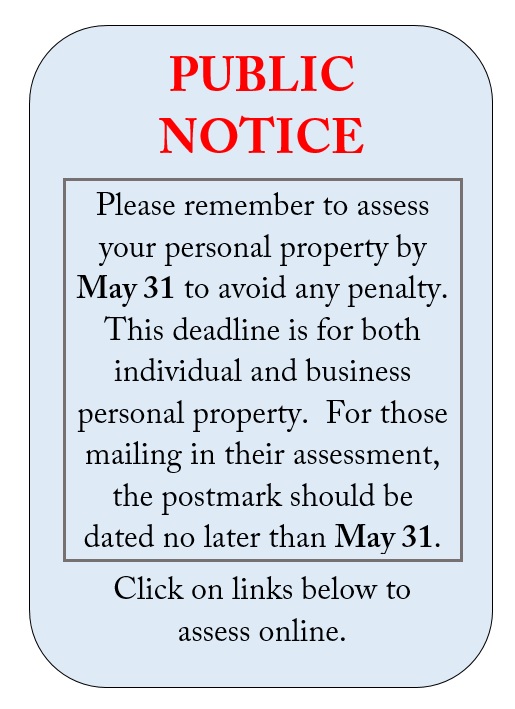

Arkansas Estate Tax Return andor Pay Estate Tax AR321E File this request in triplicate on or before the due date of the return. If you choose to electronically file your State of Arkansas tax return by using one of the online web providers you are required to complete the form AR8453-OL. 2021 Arkansas Tax Rates.

604 - W-2 Forms -. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. 1 of the amount over 0.

Check the status of your Arkansas Income Tax return. AR1000NR Part Year or Non-Resident Individual Income Tax. One 1 copy of the approved request must be attached to.

Online payments are available for most counties. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. 602 - Extensions of Time to File.

Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued. Go to Income Tax Refund Inquiry. Arkansas also does not have a gift tax.

If you make 70000 a year living in the region of Arkansas USA you will be taxed 12387. Check your refund status at. If taxable income more than - but not over - the tax is.

Your average tax rate is 1198 and your marginal. Box 1000 Little Rock Arkansas 72203-1000 Mail No. 601 - How to Request Copies of Tax Returns.

Arkansas Income Tax Calculator 2021. AR1000NOL Schedule of Net Operating Loss. Tax returns and on the Arkansas.

On Arkansas income tax returns taxpayers must file following the rules in sections 167 168 179 and 179A under the Internal Revenue Code of 1986 enacted January 1 1999. 4810 for Form 709 gift tax only. Want to avoid paying a.

It allows the states residents simply gift away the taxable parts of their estates and protect their inheritance. AR1000F Full Year Resident Individual Income Tax Return. In the case of the estate of a resident or a nonresident who dies having real property andor tangible personal property.

Property Tax Calculator Smartasset

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Prepare An Estate Tax Return Form 706 For Marcia Miller Who Died Docx Prepare An Estate Tax Return Form 706 For Marcia Miller Who Died July Course Hero

Estate Tax Rates Forms For 2022 State By State Table

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Arkansas Estate Tax Everything You Need To Know Smartasset

Guide To Arkansas Closing Costs In 2021 Newhomesource

How Do State And Local Property Taxes Work Tax Policy Center

Guide To Resolving Arkansas Back Taxes Other Tax Problems

When A Gift May Not Be A Gift Miller Butler Schneider Pawlik And Rozzell Northwest Arkansas Attorneys

2021 State Corporate Tax Rates And Brackets Tax Foundation

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Tax Rates Rankings Arkansas State Taxes Tax Foundation

Arkansas Realtors Association Real Estate Contract Form Fill Out And Sign Printable Pdf Template Signnow

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation